WPG Partners

A commitment to small caps.

A traditional value focus.

A process built on unparalleled research.

At WPG Partners, we’ve been investing exclusively in small- and micro-cap companies for more than 25 years. Our approach focuses on identifying overlooked, fundamentally strong companies that are experiencing an inflection point in their business cycles.

A value-oriented approach to small-cap investing

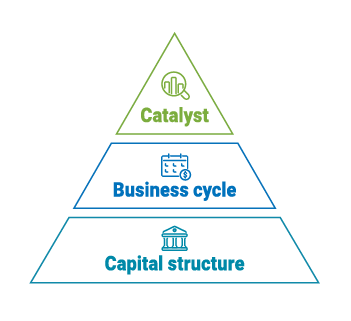

We buy stocks that exhibit:

- Improving capital structures and sound fundamentals

- Inflection points in the business cycle

- Catalysts for sustained positive change

We sell stocks based on:

- Deteriorating balance sheets and weakening fundamentals

- Decreasing demand, margins, and earnings

- Heightened capital requirements or competitive threats

We believe identifying overlooked businesses with improving fundamentals gives us a competitive advantage.

Finding these unique opportunities requires extensive fundamental research. Our process combines comprehensive stock screens, inputs from diverse industry contacts, and hands-on original research, including more than 700 company meetings a year.

Meet the team

Our offerings

Today, our lineup offers multiple ways to invest, including a concentrated portfolio, a dedicated micro-cap strategy, and a new long/short offering.

Strategy | Total strategy AUM ($) | Inception date | Security range | Portfolio managers |

|---|---|---|---|---|

Small Cap Diversified | 668.0 M | 10/1/99 | 80–120 | Gregory Weiss, Richard Shuster, Eric Gandhi |

Micro Cap Opportunities | 324.2 M | 10/1/08 | 80–120 | Gregory Weiss, Richard Shuster, Eric Gandhi |

Select Small Cap Value | 1.6 B | 12/1/18 | 30–50 | Eric Gandhi |

As of 9/30/2025.

Our latest thinking on the markets

7751341.1