The surge in power demand: harnessing the investment implications

DECEMBER 2024

Much has been written about the looming surge in electricity demand the United States will likely face in the coming years. The nearly insatiable appetite for power that new artificial intelligence (AI) data centers will entail is just one part of the story; the continued push for onshoring, the ongoing expansion of electricity’s role as a power source, and more routine upgrades to data processing all point to the inevitable conclusion that the United States’ 20-year plateau in electricity consumption cannot last. To the contrary, we believe that the supply response is already breathing life into several often-overlooked subsectors and that new investment opportunities are already emerging. This is especially true within the transmission and distribution segment, where we believe speed to market and relative cost benefits offer tremendous advantages over other power supply-generation alternatives.

Onshoring is happening now, and new power demands are likely close behind

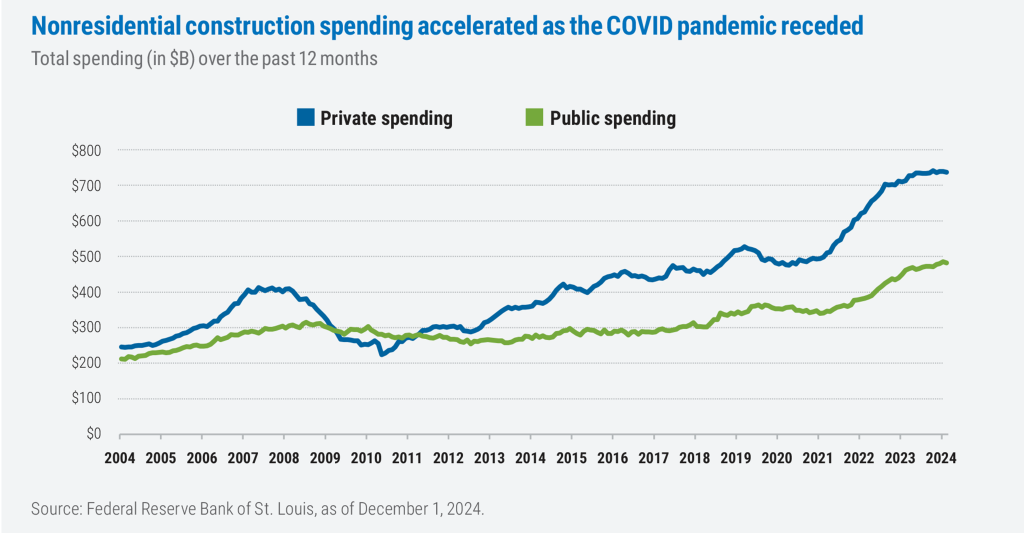

One basic reflection of the pent-up demand for power is to look at the high-level spending patterns

in recent years on capital improvements. That pattern, so far this century, has generally been one of two steps forward, one step back: The global financial crisis dealt a significant blow to nonresidential

construction spending, with both public and private spending taking almost a full decade to reclaim

their 2008 levels—before getting knocked back again by the COVID pandemic. We’ve argued that

capital expenditures (CapEx) on fixed-asset infrastructure are now finally in the early stages of a

more sustained recovery, as evidenced by the significant uptick in the past three years.

This trend is significant because commercial and industrial end-markets collectively consume about two-thirds of the power generated in the United States. And because electricity demand can lag construction spending by 12–36 months, we believe the added power demand implied by the post- COVID spending resurgence has yet to fully materialize. A mild acceleration in the growth of these two end-markets to just 3% annually could lead to an additional 10,000 megawatts (MW) per year of power consumption (or roughly 2% demand growth), compared to the nearly zero growth over the past decade.

The electrification of everything

The United States is beginning to harness the power of electricity across many end-use applications, from transportation to heating and cooling applications to plant automation. This dynamic is itself a tailwind beyond just the onshoring of industrial and commercial production. For example, annual electric vehicle (EV) sales in the United States are expected to cross 7.7 million in 2030, taking the number of EVs on the road to an estimated 36 million. On average, a single EV currently consumes 0.3 kilowatt-hours (kWh) of energy per mile or about 5 megawatt-hours (MWh) a year per car. Assuming demand growth of 3% per year, this translates to around 15,000 MW ofincreased annual energy consumption solely from electric vehicles.

Eric Gandhi, CFA

Portfolio Manager

Robert Hellauer

Research Analyst

WPG Select Small Cap Value

A concentrated portfolio of our highest-conviction small-cap ideas managed by the veteran team at WPG Partners.

WPG Partners Small Cap Value Diversified Fund

A more broadly-diversified portfolio of small-cap stocks built on WPG’s time-tested approach.

AI data centers represent a massive net new source of power demand

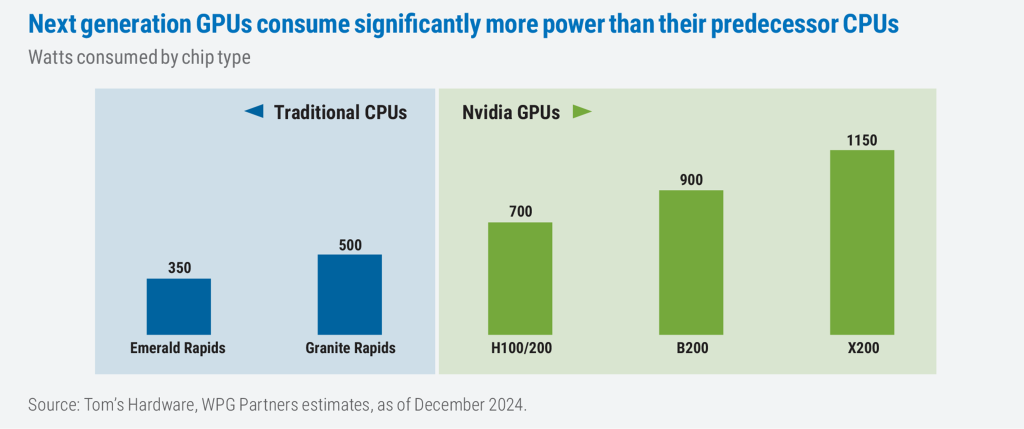

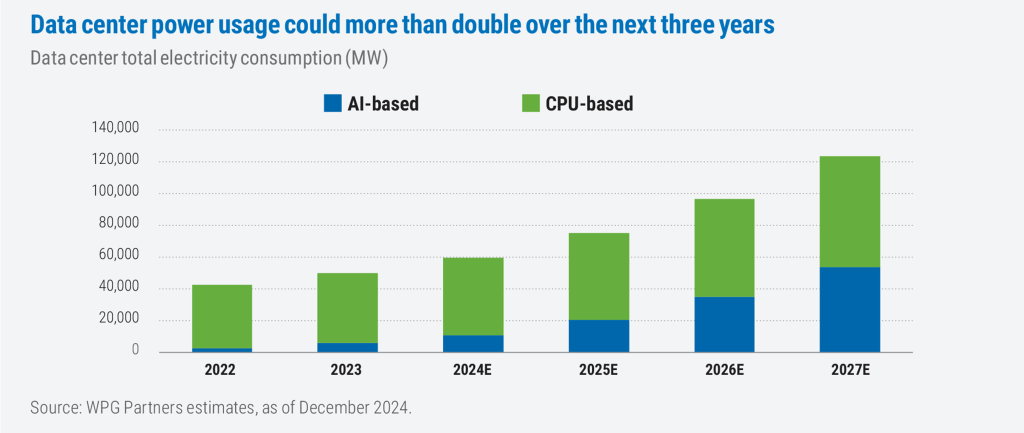

Since the introduction of ChatGPT by OpenAI in late 2022, broad commercial demand for artificial intelligence infrastructure has surged. The equipment and facilities required to run large language models and other applications need somewhere between 4–10x more power usage than traditional data centers. On average, the current and next-gen graphics processing units (GPUs) consume twice the power per chip of traditional central processing units (CPUs), and each AI server contains an average of eight GPUs compared with traditional data center servers that run on just two CPUs.

Industry analysts forecast approximately 1.5 million AI servers to be shipped in 2025 in addition to 12 million traditional data center servers, some fraction of which will replace older servers. We forecast energy consumption of net new data centers to grow from approximately 7,000 MW in 2023 to around 25,000 MW in 2027. Total energy consumption by data centers in the coming years could reach 120,000 MW, or more than 20% of the total U.S. demand for power. Note, this increase reflects not only net new AI servers, but also the increased energy demands of next-generation servers that are more power intensive.

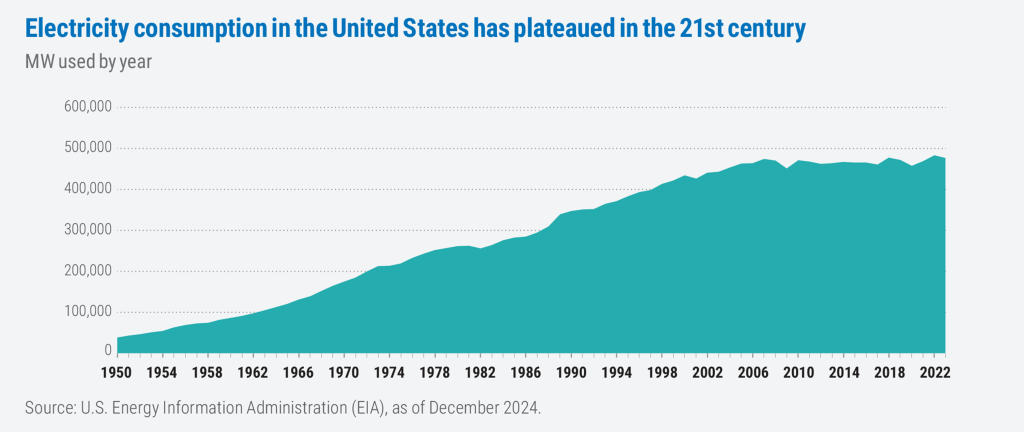

The recent plateau in power consumption now looks like the exception, not the rule

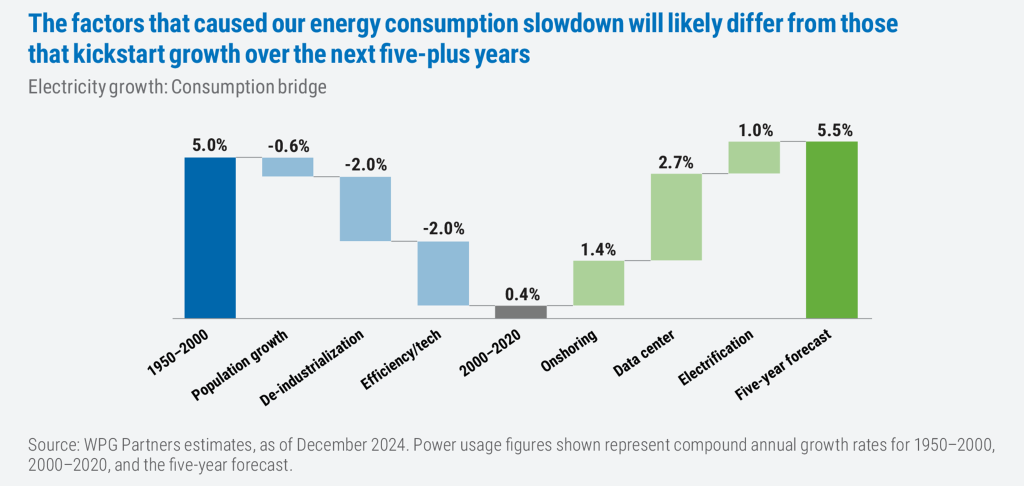

From 1950 to 2000, power consumption in the United States grew by roughly 5% per year before flatlining at about 475,000 MW since the early 2000s. In our view, this recent sideways trend was driven by two factors. First, the de-industrialization of the U.S. economy: Manufacturing capacity has been nearly flat since 2000 and has declined in absolute terms since 2007. Second, energy efficiency initiatives via two forms: advancements in appliance, lighting, and HVAC systems and, at the same time, the increasingly widespread adoption of more power-efficient technological processes (e.g., cloud computing).

As we’ve outlined, we believe that neither of these trends are likely to continue in the years ahead, and that the trend in power consumption over the next several years will more closely resemble the second half of the 20th century than the recent past. Our base-case forecast, based on the tailwinds outlined above, calls for an additional 35,000 MW of power requirements by 2027, which implies about a 5% compound annual growth rate (CAGR) in total power consumption.

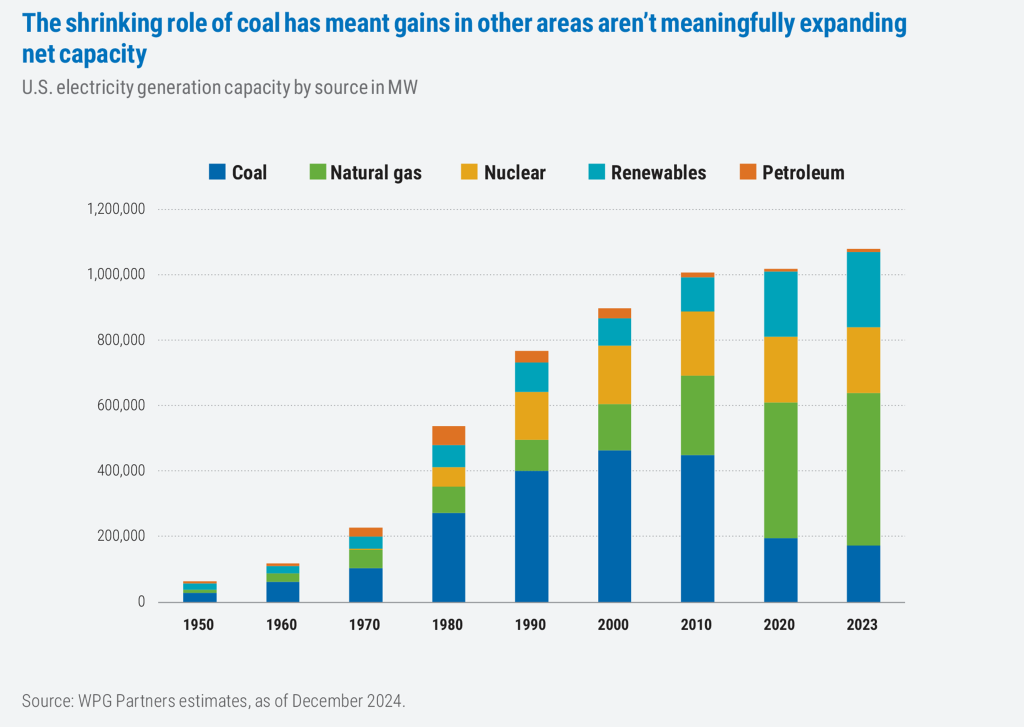

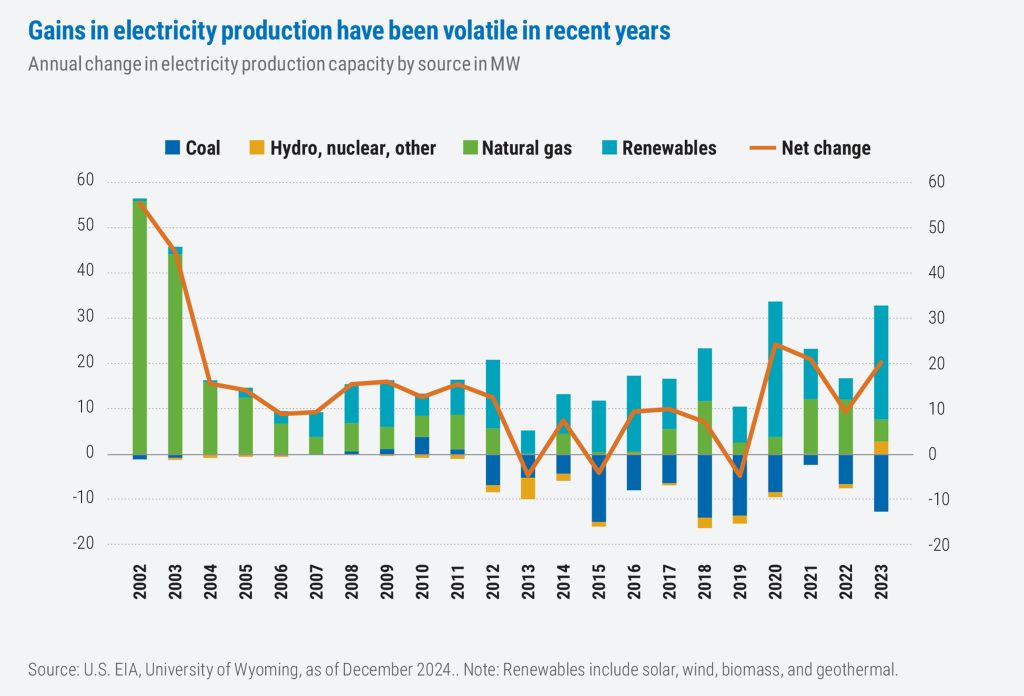

Supplying additional demand for power won’t be quick or easy

The obvious question implied by the projected increase in demand is, where will the new supply come from? As of 2023, the United States had a total power production capacity of approximately 1.1 million MW, with 60% coming from fossil fuels, 20% from nuclear, and 20% from renewable energy. Over the past 10 years, capacity has grown at a paltry 1% CAGR, with coal-fired energy production declining at 9% CAGR while natural gas and renewable energy grew at 5% and 13%, respectively.

The solution to the coming supply crunch is not as simple as merely meeting the uptick in demand. Power suppliers like to reserve a buffer of up to 20% spare capacity to tap during periods of demand spikes, and seasonal peak-to-trough changes in electricity demand generally average around 30%; outlier spikes in demand can reach 50% above peak levels, as seen in Texas and the mid-atlantic region over the last decade. Further complicating this dynamic is the fact that solar and wind energy have relatively low, highly variable capacity factors—they produce less power than their nameplate (i.e., their total stated capacity) and at different times of the year depending on weather patterns.

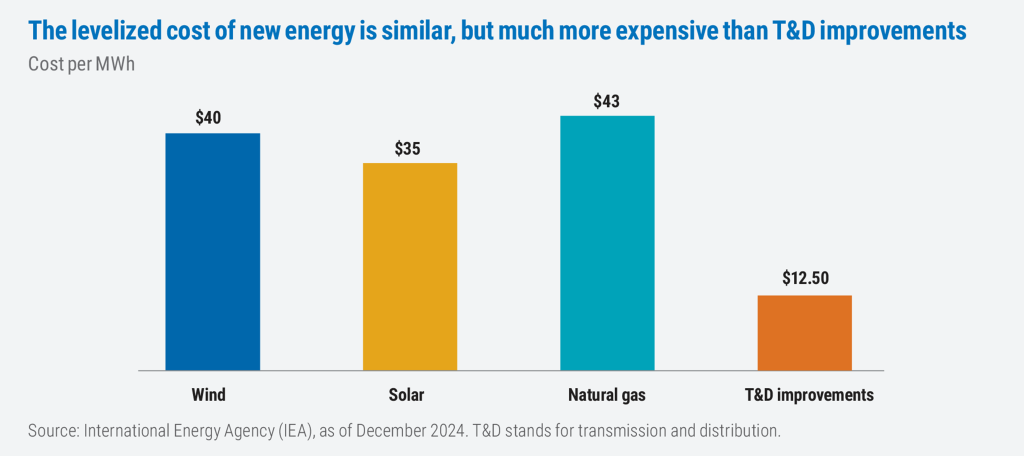

We expect utility companies to meet the increased demand with a broad array of supply responses: investment in new renewables and natural gas plants, but also in new and improved delivery and transmission infrastructure. In fact, the cheapest means of increasing electricity supply is often through upgraded and broader transmission connectivity, which can unlock load imbalances and allow electricity to flow from areas where there is a surplus to those where there’s a deficit.

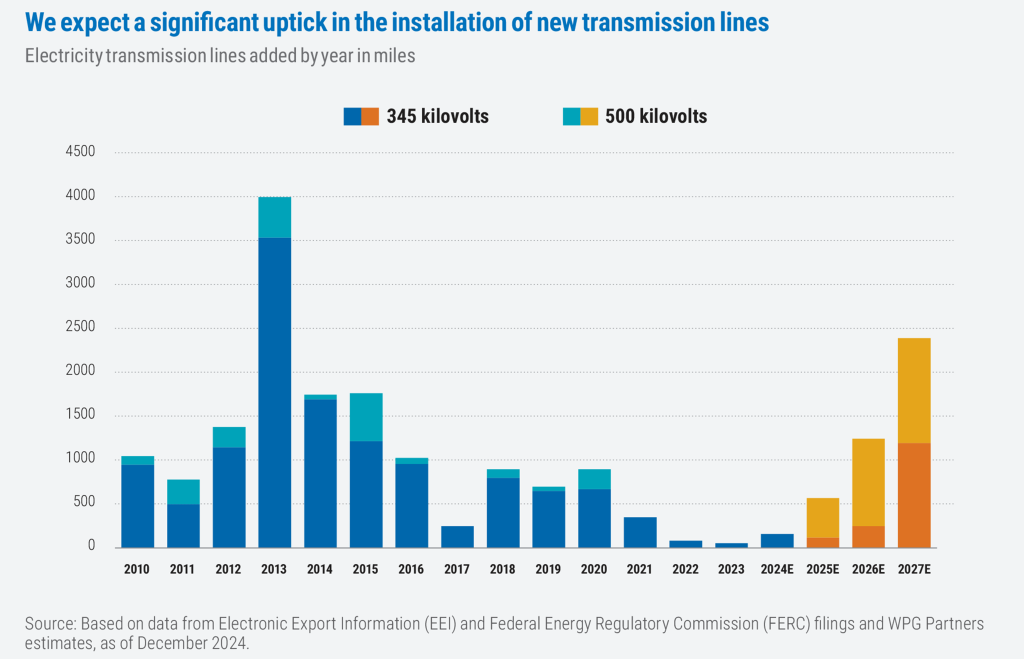

Investment in new transmission lines has been low for nearly a decade, resulting in limited new transmission access and aging grid lines, with roughly 25% of the existing infrastructure now at least 50 years old. That said, we believe this under-investment in transmission is near its end. According to the EIA, it costs roughly $1 billion to greenfield a plant (i.e., to complete a net new development) capable of delivering 1,000 MW, whereas it costs just $300 million in transmission improvements to unlock 1,000 MW of “trapped” electricity (i.e., electricity that is inefficiently or ineffectively transmitted). Given that transmission and distribution improvements are as much as 70% cheaper and significantly faster than greenfielding an equivalent amount of new electricity, we expect this segment will receive heightened interest—and likely heightened capital investment.

We’ve been tracking more than 10 different transmission improvement projects that have been in the permitting process for eight years on average and are currently either approved or within months of obtaining final approval. In aggregate, these projects represent more than 4,000 miles of new transmission grid and $20 billion worth of total CapEx to be invested. We expect each project to break ground over the next 18 months, with an average construction timeline of around three years.

Beyond these projects, there is a permitting queue representing an additional 7,000–8,000 miles worth of near-term transmission projects, which reflects another $50 billion to $60 billion of CapEx. With the upcoming change in the federal government administration, we expect the regulatory environment may loosen, unleashing tailwinds to transmission spending. President-elect Trump has explicitly discussed loosening permitting regulations to boost electricity generation, including the formation of the National Energy Council on November 15, 2024, whose aim will be to coordinate federal regulations to enhance U.S. energy production and reduce excessive regulation.

The downstream effects of transmission improvement investments are significant

Transmission improvement projects tend to be outsourced, which is often beneficial to those industrial companies that support electricity providers in the utilities ecosystem. Moreover, this trend has become even more pronounced over the past decade, with nearly 40% of spending allocated to vendors.

Besides investments in transmission, the burgeoning load growth will need to be met with the development of a new generation of solar, wind, and natural gas production facilities, all of which have an approximately equal levelized cost of energy.

Due to the seasonality issue and the capacity dynamics associated with most renewable energy sources, we believe we’ll see some meaningful investment in new natural gas generation. Case in point, gas turbine orders are expected to reach a level by the end of this year not seen since 2013.

Demand for commodities appears poised to climb

Steel, aluminum, and copper are the primary metals in the electric grid, with steel used solely in poles and towers, and aluminum and copper used in cables and wiring. Currently, approximately 10%–12% of total aluminum consumption in the United States goes into transmission and distribution wires and cable infrastructure. Given that we expect transmission spending to increase 30% by 2027, we’d expect a corresponding incremental growth of at least 3% in the annual demand for aluminum. Regarding copper, where 30% of total production is used in electrical wiring, we expect the total consumption to increase as well, though with a broader range of end uses. We expect the overarching electrification trend to drive a high single-digit or low double-digit percentage increase in global consumption of copper over the next few years.

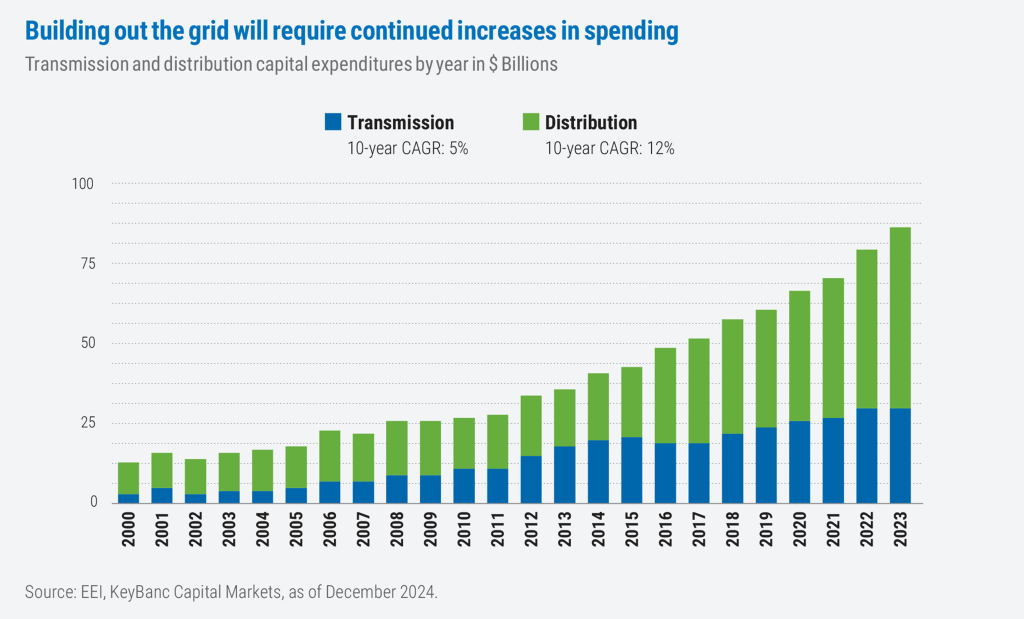

The backlog for new construction has already begun

Counter to some of the other trends in the electricity ecosystem, utilities have been increasing their CapEx in recent years—investing in maintenance, grid hardening, and serving new residential demand patterns. We expect this trend to accelerate with the arrival of net new demand, especially with regard to transmission infrastructure spending. In fact, the backlog of work orders at some of the largest transmission and distribution construction companies has grown by 14% annually over the past decade. Importantly, given the unique nature of the skilled labor required, pricing at these companies—and subsequently margins—are trending higher.

Capitalizing on the increasing demand for electricity requires a nimble, proactive investment approach

As we’ve seen, there are myriad factors driving demand for more electricity in the United States higher. Even if the current hype surrounding AI proves to contain a healthy dose of wishful thinking, we believe the plateau in demand the United States has experienced over the past 20 years is unsustainable. Additional supply, therefore, is a necessity, we believe—and the wheels to provide it are already in motion. New power plants will likely be required, particularly those fueled by natural gas and renewable sources. But new generation facilities will only be one piece of the puzzle, and capital improvements to the existing grid, many of which we feel are long overdue, will be needed to meet the surge in demand. The beneficiaries in many cases will be the small, specialized industrial companies that utilities providers rely upon to implement their CapEx programs. At WPG Partners, we believe our investment process, built on intensive fundamental research, puts us in a strong position to identify attractively valued companies poised to benefit from the emerging push for power—and ultimately to help our clients capitalize on the economic implications.

7451393.1

Important disclosures:

The opinions expressed are those of the contributors as of the publication date and are subject to change. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, mutual fund, sector, or index. Boston Partners and affiliates, employees, and clients may hold or trade the securities mentioned in this commentary. Past performance does not guarantee future results.

Important definitions:

Capital expenditures (CapEx) are investments made by a business to obtain or improve physical assets.

Investment risks:

Stocks and bonds can decline due to adverse issuer, market, regulatory, or economic developments; foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability; value stocks may decline in price; growth stocks may be more susceptible to earnings disappointments; the securities of small companies are subject to higher volatility than those of larger, more established companies. This material is not intended to be, nor shall it be interpreted or construed as, a recommendation or providing advice, impartial or otherwise.

Boston Partners Global Investors, Inc. (Boston Partners) is an Investment Adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training. Boston Partners is an indirect, wholly owned subsidiary of ORIX Corporation of Japan. Boston Partners updated its firm description as of November 2018 to reflect changes in its divisional structure. Boston Partners is comprised of two divisions, Boston Partners and Weiss, Peck & Greer Partners.

Securities offered through Boston Partners Securities, LLC, an affiliate of Boston Partners.