Are the Magnificent Seven losing momentum?

SEPTEMBER 2024

For the past 18 months, one question has dominated conversations about the U.S. equity market: How much longer can the Magnificent Seven continue to outperform? No one can say for sure, and while it’s true that cracks are potentially beginning to show in the fundamentals of these tech-related mega caps, predicting a market top has always been a murky business.

A few things are clear, however, and worth noting. The first is the sheer magnitude of the largest companies’ outperformance of the broader market: The Magnificent Seven have generated nearly 60% of the S&P 500 Index’s return year to date through June; in 2023, that figure was 62%. The performance disparity between these few stocks and the rest of the market has been so severe that the Magnificent Seven now represent more than 30% of the S&P 500 Index—and that’s after accounting for a recent drawdown. Within growth stocks, the imbalance is even more exaggerated: Just three stocks in the Russell 1000 Growth Index represent one-third of the index.

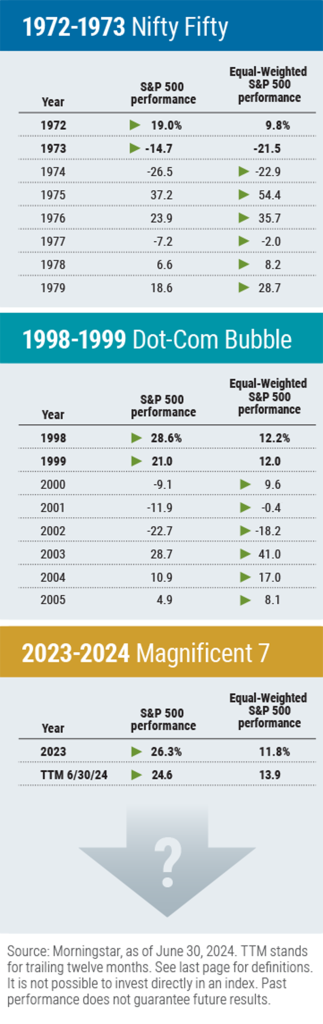

The second observation is that these kinds of periods of concentrated outperformance in the stock market are not unprecedented—think the Nifty Fifty in the early 1970s and the Dot-Com Bubble in the early 2000s. And when these streaks end, as they invariably do, the reversals can be sudden and severe.

Large Cap Value

Our flagship U.S. equity strategy targeting attractively valued large-cap companies.

Small Cap Value

An established strategy targeting undervalued small companies in the United States.

Consider that in 2023 and again through June of 2024, the returns for the S&P 500 Index (which is cap weighted, meaning individual stocks’ weightings are proportional to their overall market value) were roughly double that of an equal-weighted investment in those same 500 companies. Similar patterns of outperformance took place with both the Nifty Fifty and with tech stocks in 1998–1999. In both cases, when the trend reversed course, an equal-weighted S&P 500 went on to outperform the standard cap-weighted index for six years in a row.

There’s no single reason behind these reversals, but there is a common theme: Companies with lofty valuations tend to come with equally high expectations attached. When growth stalls or fails to meet those high expectations—whether through heightened competition, increased regulation, or management missteps—the consequence has often been a swift repricing.

Recent results for Magnificent Seven companies have raised concerns

Could we be experiencing early indications of a market reversal? So far, the Magnificent Seven companies have reported mixed results in the second quarter of 2024. Apple reported earnings per share marginally above expectations, but revenue declined year-over-year after a fall in iPhone sales. Microsoft, Alphabet, Amazon, and Meta all exceeded earnings expectations, but reported ongoing challenges with different parts of their businesses: questionable sustainability of growth in Microsoft’s Azure platform, slowing revenue growth in Alphabet’s YouTube advertising business, ongoing operating losses at Meta’s Reality Labs division, and recent antitrust rulings in Europe against Apple’s App Store and music platform. Tesla’s earnings, meanwhile, disappointed as operating profits slid 33% year-over-year on lower automotive sales prices and stiffer electric vehicle competition.

Value stocks appear poised for an earnings rebound

All of these factors considered, looking ahead the expectations are for the Magnificent Seven’s earnings growth by the fourth quarter to decelerate to a rate only slightly higher than that of the Russell 1000 Growth Index. Meanwhile, large-cap value stocks are expected to continue strengthening their earnings figures, rebounding from around 3% growth in Q2 to more than 15% by year end.

The question facing investors is how much they’re willing to pay for these levels of earnings growth. As of this writing, the Russell 1000 Value Index reflected a price/earnings ratio of the cheapest of the Magnificent Seven, meanwhile, had a P/E of about 24x, and two of the seven were over 50x. If the momentum fueling the rise of the Magnificent Seven stalls, it could suggest a meaningful resurgence in value-oriented and smaller-capitalization stocks.

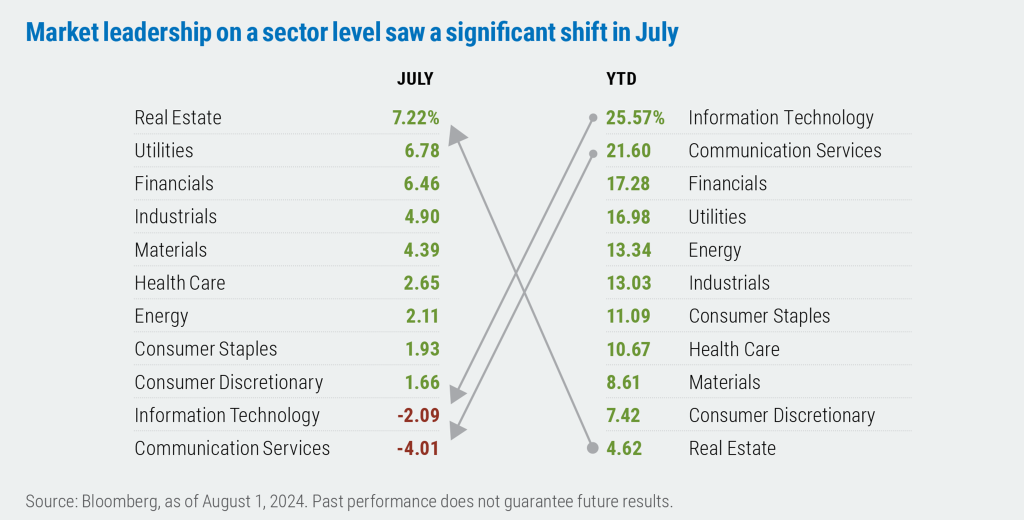

One month of data is too little from which to draw any meaningful conclusions, but it is noteworthy that the worst-performing sector over the first six months, Real Estate, led the market in July, while the two best-performing sectors through June, Information Technology and Communication Services, were the only two posting losses in that month. Similarly, value outperformed growth across all market capitalizations in July, while small- and midcap stocks outperformed large caps.

Diversification may be more important—and challenging—than usual

Only hindsight will reveal precisely when investors have lost their appetite for today’s high-flying tech stocks. But we can say with confidence that, over the long term, valuation matters in the equity market, and that chasing yesterday’s winners rarely ends well. Consider the recent, short-lived turmoil that hit the markets at the beginning of August and erased approximately $800 billion in market value of the Magnificent Seven in just one day.

Investors following a passive or index-oriented approach may discover too late just how exposed they are to the fortunes of a handful of tech-related mega caps. If history is any guide, when market leadership changes, that change can often be both abrupt (as 2022 as for tech) and protracted (it took roughly 15 years for tech stocks to recapture their highs from 2000). We believe achieving a meaningful level of diversification in today’s market requires a hands-on, active approach—and after the spike in volatility in early August, we’d suggest investors prepare for the possibility of more turbulence on the horizon before it arrives.

7239035.1

The opinions expressed are those of the contributors as of the publication date and are subject to change. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, mutual fund, sector, or index. Boston Partners and affiliates, employees, and clients may hold or trade the securities mentioned in this commentary. Past performance does not guarantee future results.

The Dot-Com Bubble refers to a stock-market bubble primarily involving Internet-related securities that began in the late 1990s and peaked in early 2000. The Magnificent Seven refers to seven growth-oriented, tech-related companies: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. The Nifty Fifty was a group of fifty large-cap, blue-chip stocks that gained notoriety in the 1960s and 1970s due to their relatively high earnings growth and correspondingly high valuations. The Russell 1000 Growth Index tracks the performance of those large-cap U.S. equities in the Russell 1000 Index with growth style characteristics. The Russell 1000 Value Index tracks the performance of those large-cap U.S. equities in the Russell 1000 Index with value style characteristics. The S&P 500 Index tracks the performance of the 500 largest companies traded in the United States. It is not possible to invest directly in an index.

Stocks and bonds can decline due to adverse issuer, market, regulatory, or economic developments; foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability; value stocks may decline in price; growth stocks may be more susceptible to earnings disappointments; the securities of small companies are subject to higher volatility than those of larger, more established companies. This material is not intended to be, nor shall it be interpreted or construed as, a recommendation or providing advice, impartial or otherwise. Boston Partners Global Investors, Inc. (Boston Partners) is an Investment Adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training. Boston Partners is an indirect, wholly owned subsidiary of ORIX Corporation of Japan. Boston Partners updated its firm description as of November 2018 to reflect changes in its divisional structure. Boston Partners is comprised of two divisions, Boston Partners and Weiss, Peck & Greer Partners. Securities offered through Boston Partners Securities, LLC, an affiliate of Boston Partners.