Regional banks look well positioned for the next easing cycle

MAY 2024

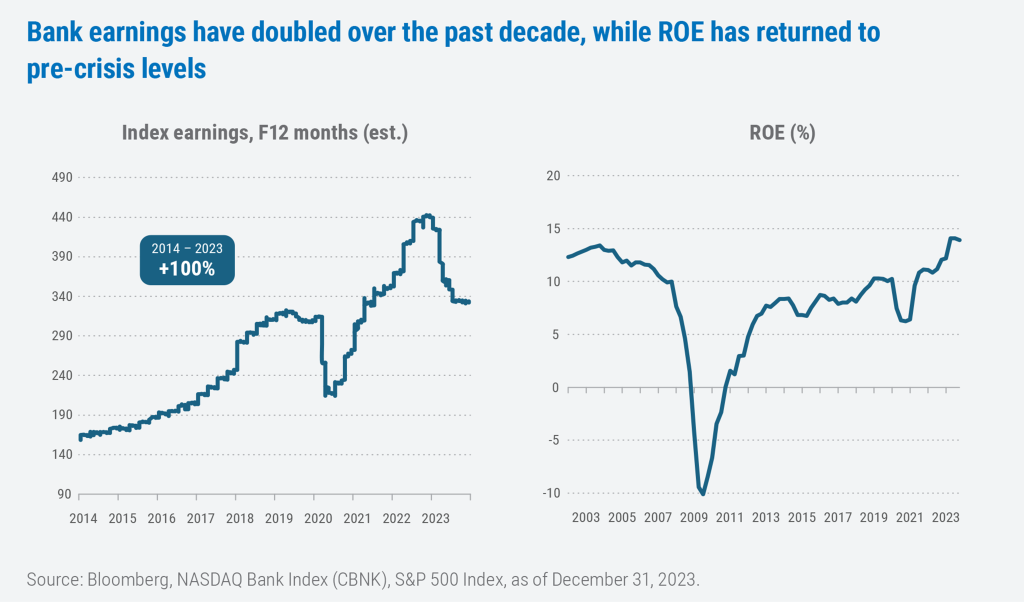

Despite solid earnings growth, valuations remain stubbornly low

Banks have had to navigate a multitude of headwinds since

the 2008 financial crisis. Beyond the obvious difficulties of the housing downturn and the subsequent MBS-led meltdown, the regulatory repercussions brought their own challenges: The Dodd-Frank Act created roughly 400 new regulations, including greater capital requirements, liquidity

buffers, additional risk monitoring, and higher compliance costs. Banks responded by paring back their high-cost branch networks and incorporating a hub-and-spoke approach to generate higher-value transactions. Banks have also spent billions on technology to nudge customers toward increasingly digital transactions, thereby

reducing the need for headcount. These efficiencies, along with capital return, have helped bank earnings double since 2014, despite the more challenging operating environment.

Earnings aren’t the only measure of banks’ improved operations. According to the Nasdaq Bank Index, a barometer for small-cap banks, return on equity (ROE) has bounced back to pre-crisis levels of around 12%.1

The elephant in the room: looming credit risks in commercial real estate

One of the factors arguably holding regional banks back from trading at higher multiples is investor concern surrounding banks’ loan portfolios. It’s been no secret that the rapid rise

in interest rates from 2022 to 2023 has created stress for commercial real estate borrowers—particularly those with low rates that are due to reset higher. From a category perspective, investors

are most concerned with the office end market, due in no small part to the glut of vacancies brought on by the post-pandemic shift to hybrid work arrangements. While the office segment deserves careful scrutiny, we believe it would be a mistake to chalk up the entire commercial real

estate (CRE) segment as a liability in today’s market.

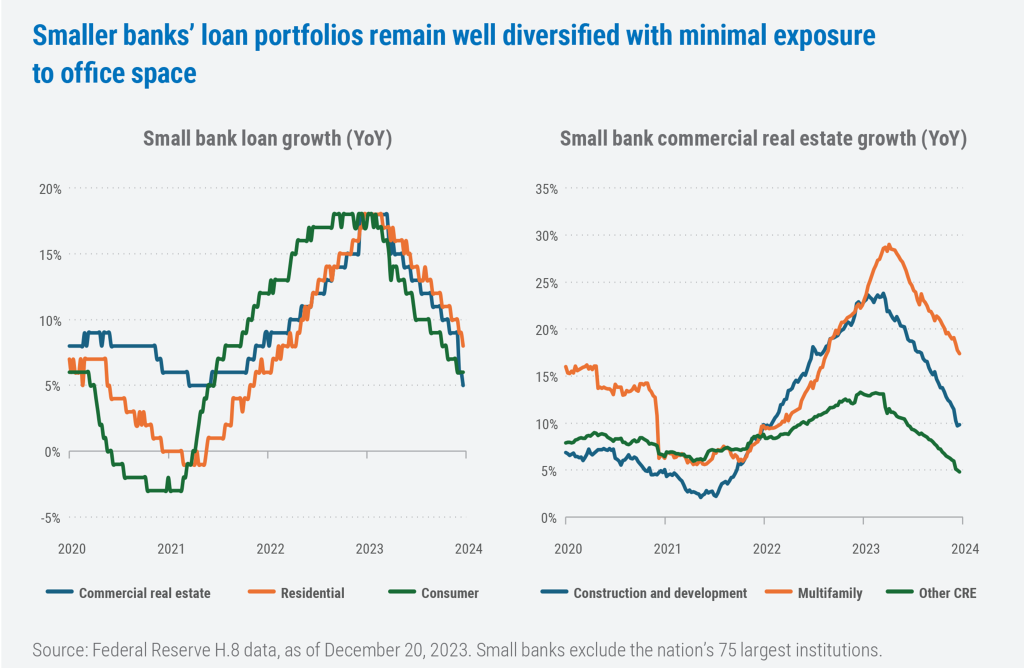

Not all commercial real estate is underwater, while small bank loan portfolios are both diverse and growing

Loans, unsurprisingly, are a significant driver of bank revenue and also a significant source of risk; maintaining a diverse and healthy loan portfolio is therefore vital to any bank’s bottom line. For small banks, we’ve seen lending that has been fairly broad based among the major categories, while within CRE specifically, the drivers of recent growth have been both multifamily and construction and development (C&D) loans. We view this as good news on two fronts—first, that smaller banks have experienced healthy absolute loan growth post pandemic and, second, that the mix of loans has been diverse with minimal exposure to the more problematic areas of the market (including office space, in particular).

It’s no surprise, then, that net charge-offs in the office space category are rising the most steeply. The good news on this front is that, although office loans aren’t uniformly disclosed by banks, mid-cap regional bank exposure to the segment runs at roughly 4%, according to analysis by Deutsche Bank.2 Moreover, capital reserves are in most cases more than sufficient to absorb stresses related to the CRE segment.

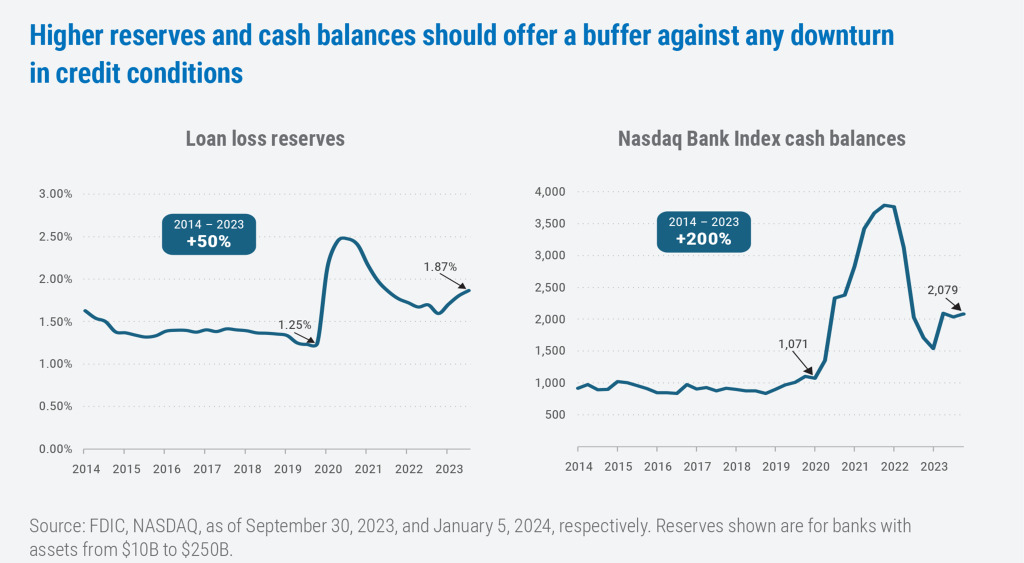

In fact, many banks have enjoyed exceptional credit trends over the last several years, with some on our radar reporting less than 10 basis points of losses per year. It’s a trend that’s unlikely to last forever, and we do expect credit conditions to normalize and losses to increase somewhat, especially if interest rates remain higher for longer. That said, banks largely look prepared for these changes: After significantly increasing their reserves during the pandemic, industry reserves are now running at 1.9% of loans among medium and larger banks, which is 50% higher than reserve levels before the pandemic.3 While a severe recession could lead to greater provisioning, these higher-than-historical reserve levels should provide some cushioning if credit were to weaken. In addition to reserves, banks’ cash balances also rose steeply during the pandemic. While this figure has come down somewhat from recent highs, cash balances are still at twice their pre-pandemic level. These higher cash balances offer another form of protection by providing liquidity in the event of a spike in deposit outflows.

With interest rates likely at their peak, liability costs for banks are poised to fall—eventually

All eyes have been on the Federal Reserve this year, as investors wait to see whether inflation falls far enough to kick off a new easing cycle. So far, the answer has been no, with core CPI stuck in the mid 3% range for the first three months four months of the year.

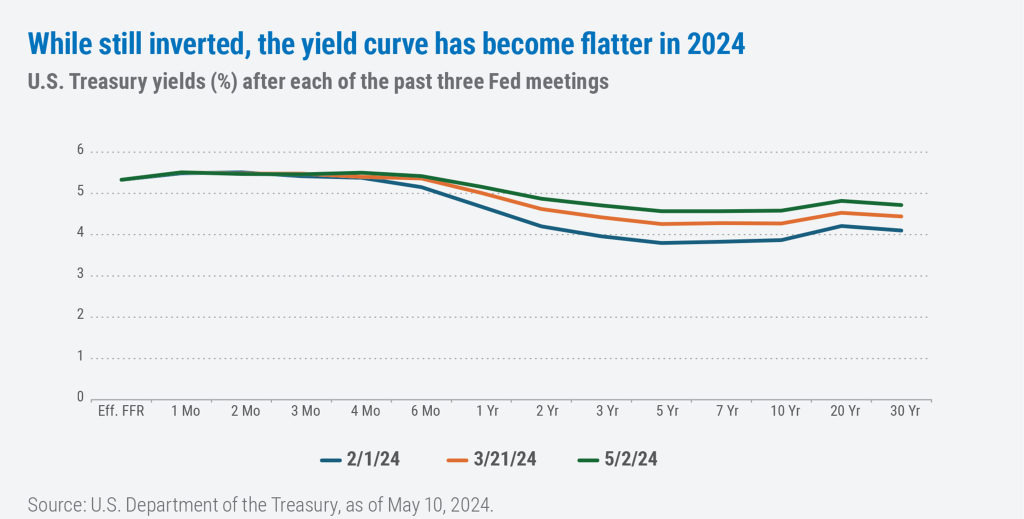

While it’s impossible to predict when the next easing cycle might begin or how far short-term rates may fall, a few things are certain. Any further normalization in the yield curve—which has been inverted since mid 2022—should act as a tailwind for banks when the Fed finally begins cutting rates and the current gap between short- and long-term rates shrinks.

According to analysis we conducted with Piper Sandler, Financials companies (including banks) typically begin to produce positive returns six months following a rate cut. Banks that reap the greatest benefits of falling short-term interest rates will generally be those that are liability sensitive—meaning, as rates fall, their net interest income will rise. As rates fall, banks’ deposit costs also decrease by a percentage of the total federal funds rate cut; this statistic is known as the deposit beta, which essentially measures the proportion of changes in short-term rates that are passed through to bank customers. We expect to see higher deposit betas this cycle given the high percentage of interest-bearing deposits at banks (71% of total assets vs. somewhat more than 60% in last cycle). All else being equal, having a higher deposit beta suggests a bank would benefit more from ongoing interest-rate reductions. Those banks with exposure to particularly high market-driven rates (i.e., CDs) should see the greatest potential benefit over time.

Conclusion

In summary, a normalized interest rate environment with a positively sloping yield curve would serve as a powerful return driver for regional banks, which are trading at a discount on both absolute and relative valuations. In addition, market share gains, which we believe are likely, can further boost growth and returns. In a sector persistently pressured by negative headlines and underweight allocations, any signs of green shoots could generate renewed interest in the banking sector and provide ample opportunities for active managers.

1 Nasdaq Bank Index, as of September 2023.

2 Deutsche Bank Research, “Cross Asset Read Throughs—Will Office CRE Break the Banks?” December 2023.

3 Banks with $10B to $250B in assets, according to FDIC data, as of September 30, 2023.

WPG Select Small Cap Value

A concentrated portfolio of our highest-conviction small-cap ideas managed by the veteran team at WPG Partners.

WPG Partners Small Cap Value Diversified Fund

A more broadly-diversified portfolio of small-cap stocks built on WPG’s time-tested approach.

6625501.2

The opinions expressed are those of the contributors as of May 2024 and are subject to change. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, mutual fund, sector, or index. Boston Partners and affiliates, employees, and clients may hold or trade the securities mentioned in this commentary. Past performance does not guarantee future results.

Stocks and bonds can decline due to adverse issuer, market, regulatory, or economic developments; foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability; value stocks may decline in price; growth stocks may be more susceptible to earnings disappointments; the securities of small companies are subject to higher volatility than those of larger, more established companies. This material is not intended to be, nor shall it be interpreted or construed as, a recommendation or providing advice, impartial or otherwise. Beta is the return generated from a portfolio that can be attributed to overall market returns. Intrinsic value is a measure of what an asset is worth, which may differ from its current market price.

Boston Partners Global Investors, Inc. (Boston Partners) is an Investment Adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training. Boston Partners is an indirect, wholly owned subsidiary of ORIX Corporation of Japan. Boston Partners updated its fi rm description as of November 2018 to refl ect changes in its divisional structure. Boston Partners is comprised of two divisions, Boston Partners and Weiss, Peck & Greer Partners.

Securities offered through Boston Partners Securities, LLC, an affiliate of Boston Partners.

“Green shoots” refers to positive economic data that may be an early indication of a turnaround or recovery.

The Nasdaq Bank Index (CBNK) tracks a range of publicly traded banks providing a broad range of financial services, including retail banking, loans and money

transmissions. The